Home

Chapter 1

Next StepsChapter 2

WorkChapter 3

BalanceChapter 4

SkillsChapter 5

SecurityWhat now?

Start your journey

Our generation is constantly searching for a security that is just out of reach

The high education and living costs in Canadian cities prior to the pandemic already made it difficult for young people to afford extra costs on top of their basic needs.

In the aftermath of the pandemic, young people are struggling more than before.

This interactive multimedia story examines the impacts of affordability in cities across Canada and the challenges young people face as they strive to meet societal expectations, experience joy and find meaning in an unaffordable time.

Searching for next steps

Imagine that you are a recent highschool graduate living through the pandemic. You have been forced to decide whether you will continue living with your family, or move to an urban centre to pursue work or education opportunities amidst great uncertainty.

By eventually moving to an urban centre, you will become part of the 70% of Canadian youth that leave rural areas for urban ones. [1] But the pandemic has complicated this path. With virtual learning and continuous lockdowns that disrupt work environments, you decide to continue living at home until there is more certainty about the pandemic.

You work a minimum wage job in your hometown and are part of the 35% of Canadian youth that are employed in the service sector,[2] but it is challenging to maintain employment because of the continuous lockdowns.

During this time, youth unemployment was higher than during the Great Recession and 15 to 24 year olds were unemployed for an average of 12.6 weeks.[3]

Employment in Canada between 2019 and 2022 for males and females age 15-24 years old

Between 15-24 years old, females have an average employment rate of 59%, higher than males 55%

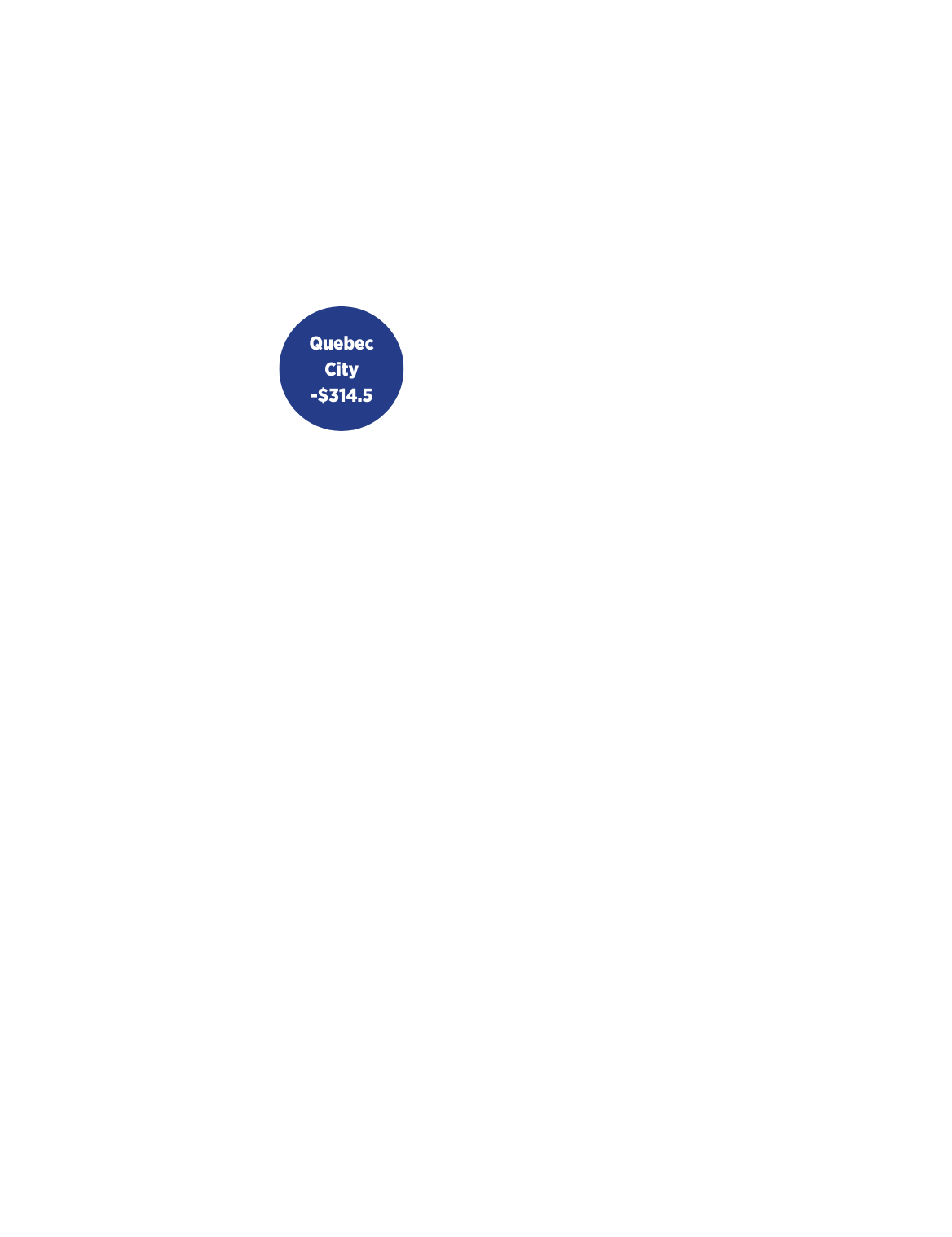

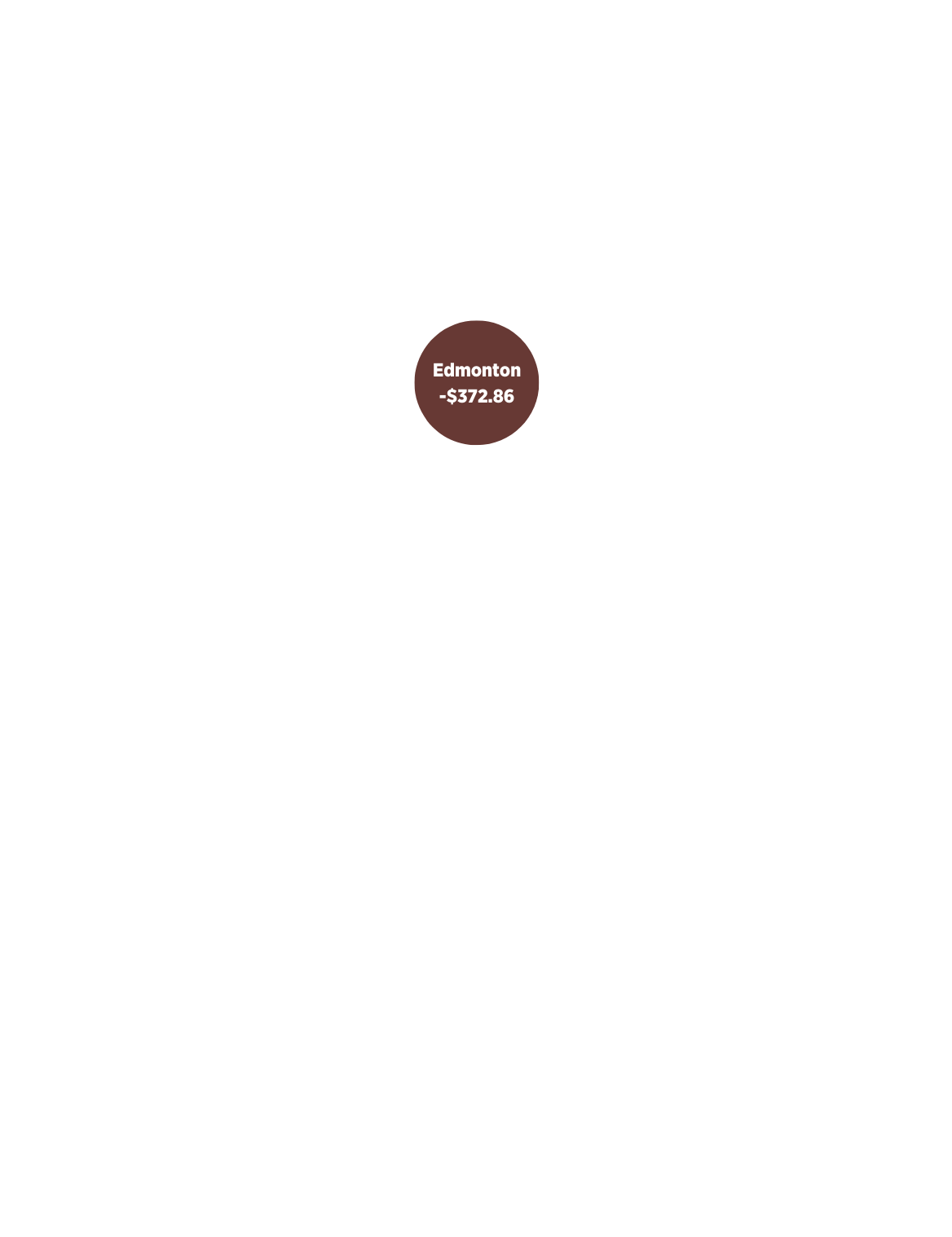

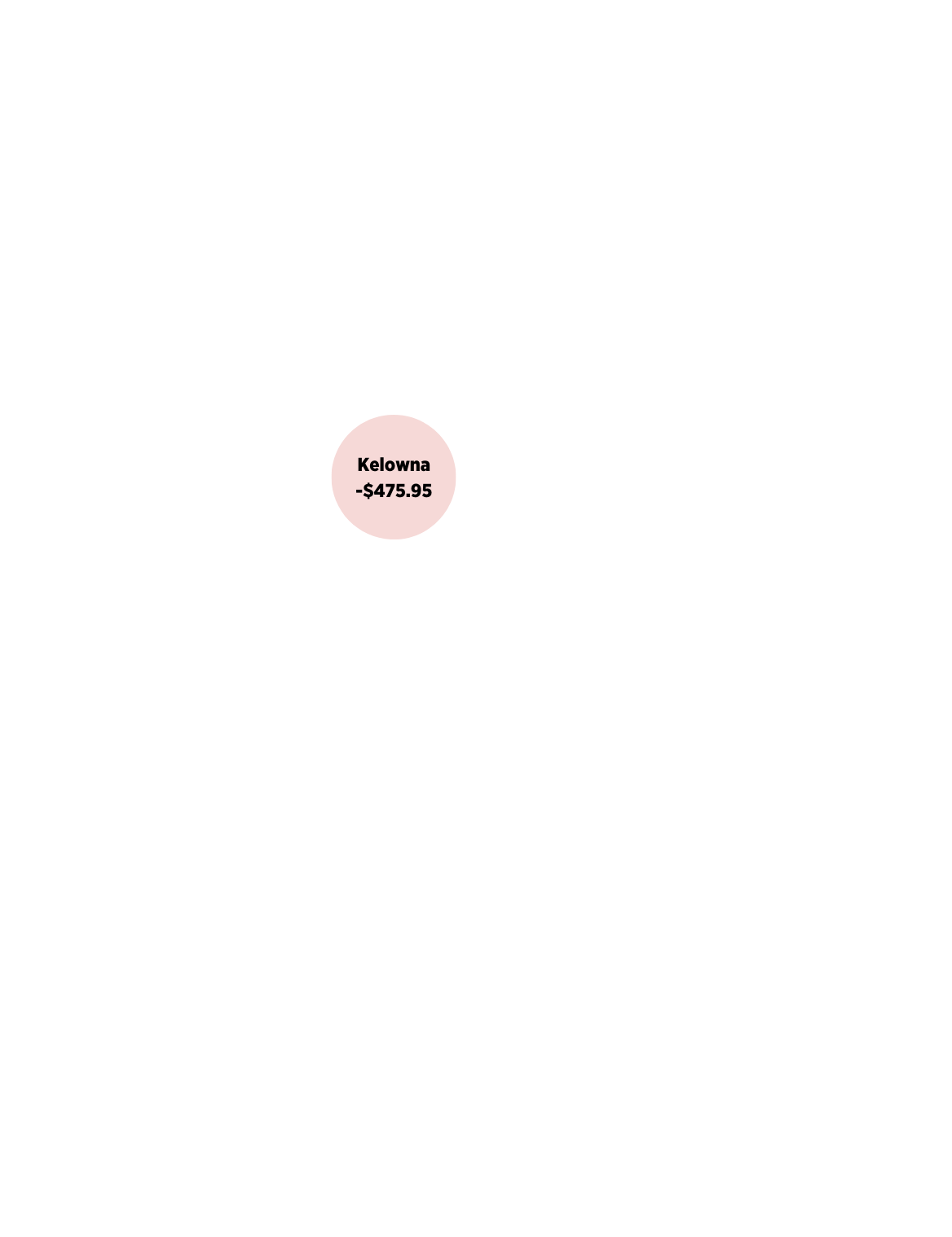

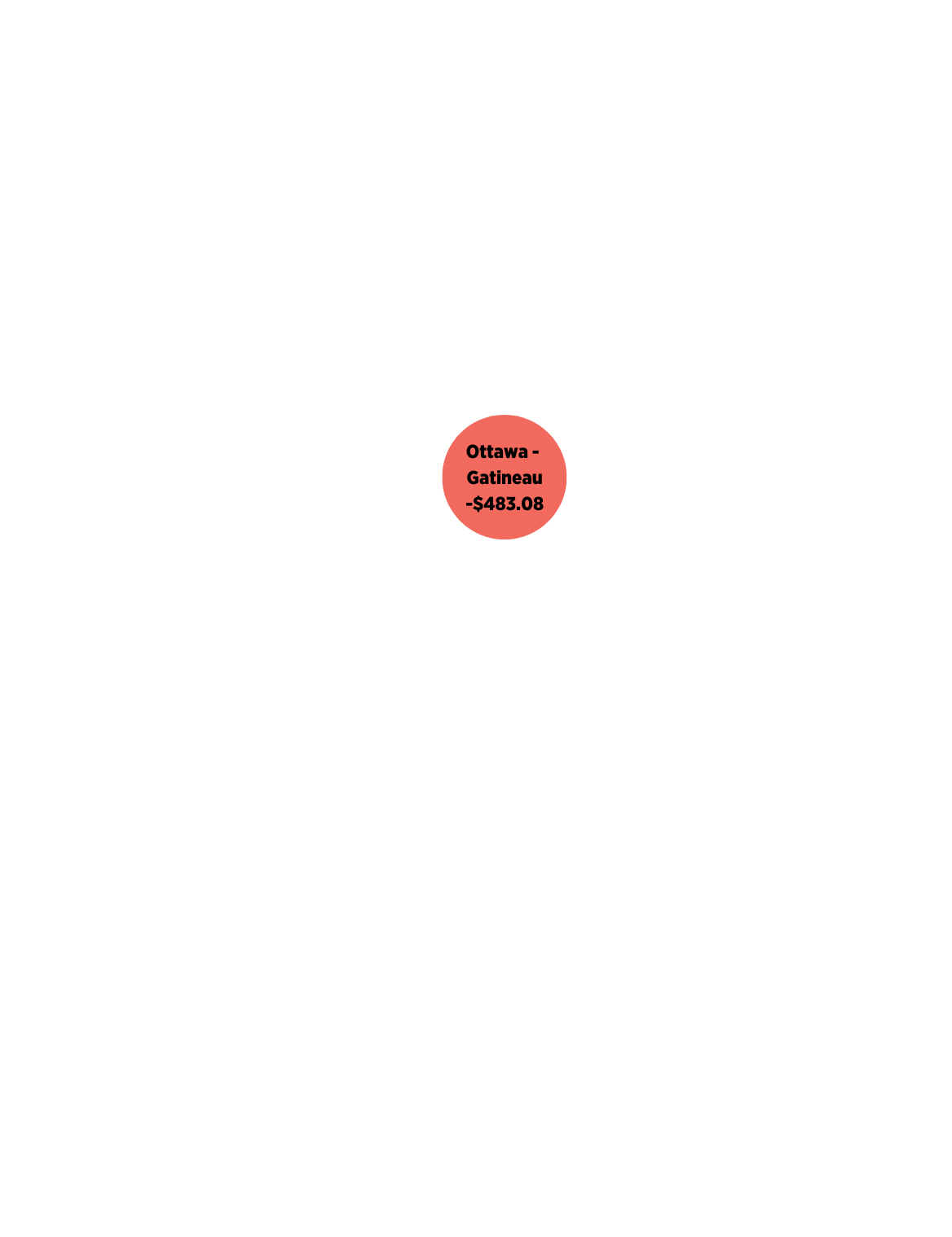

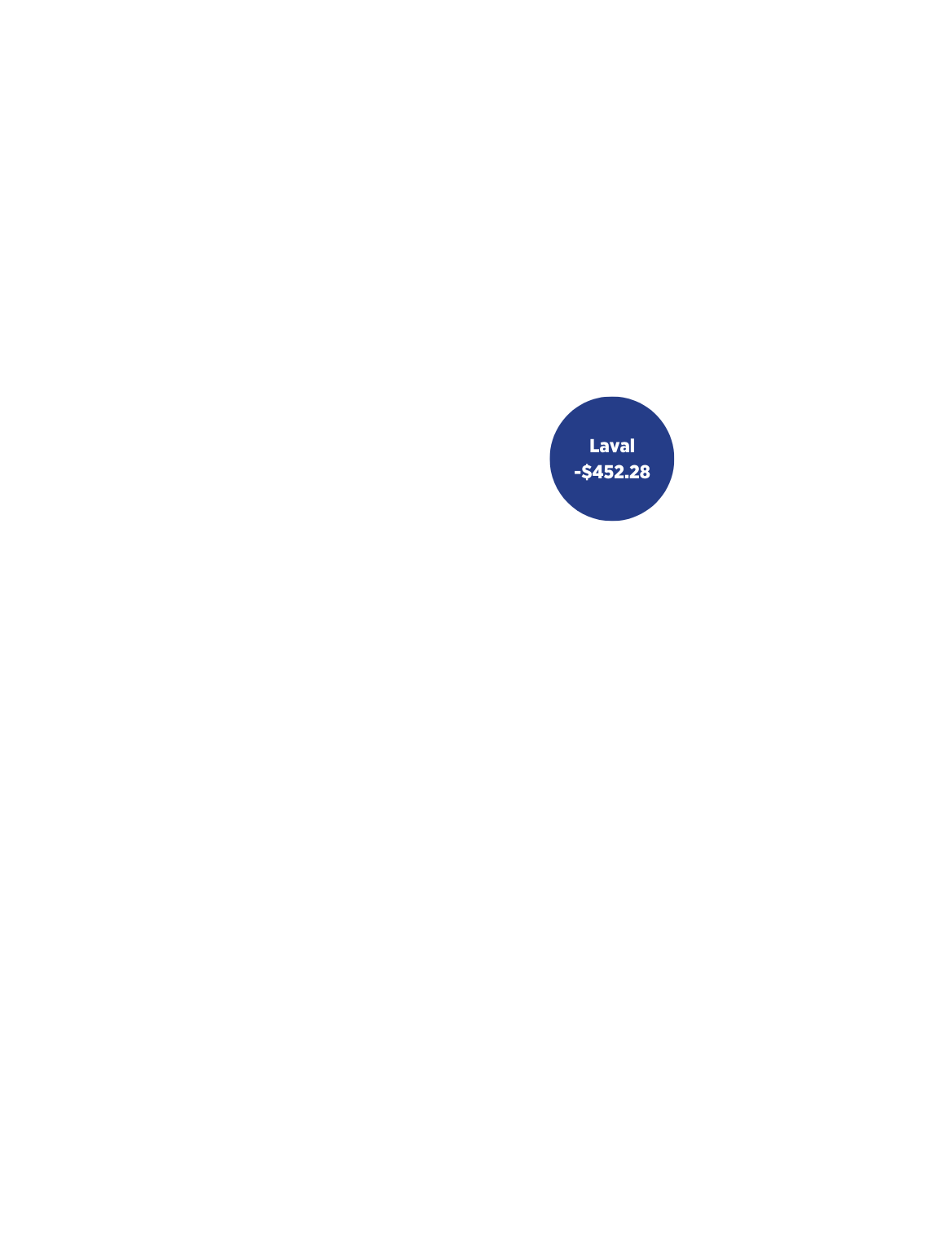

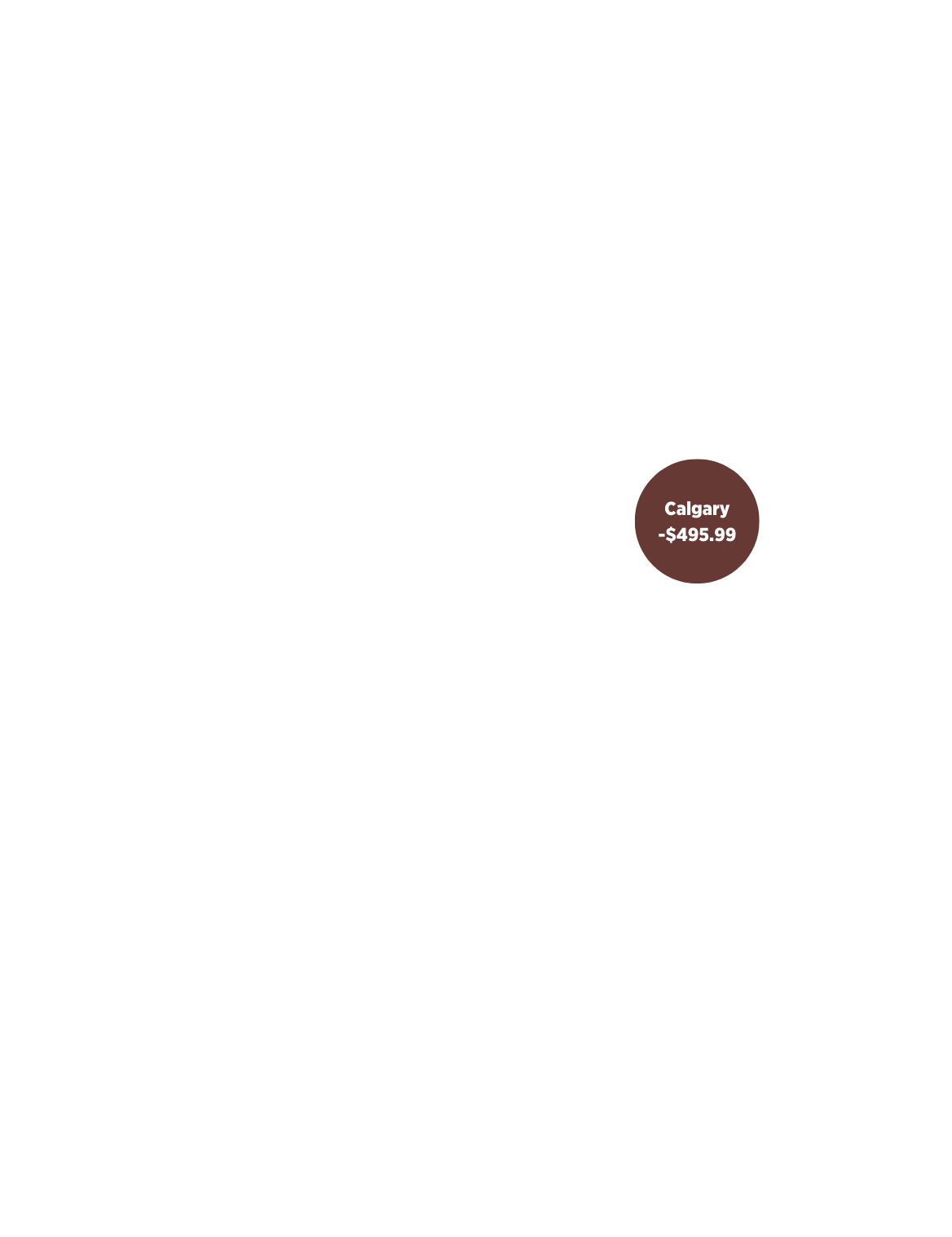

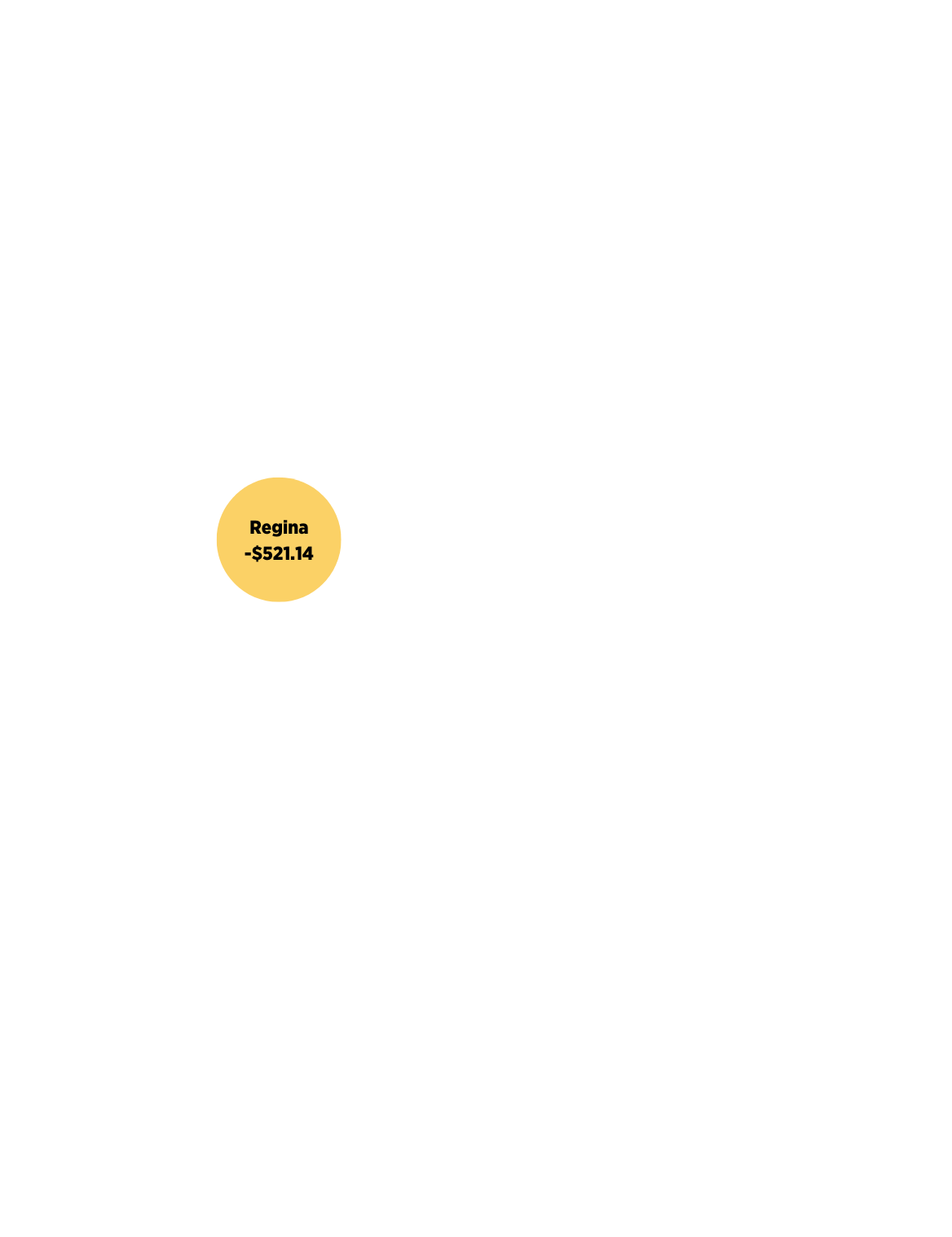

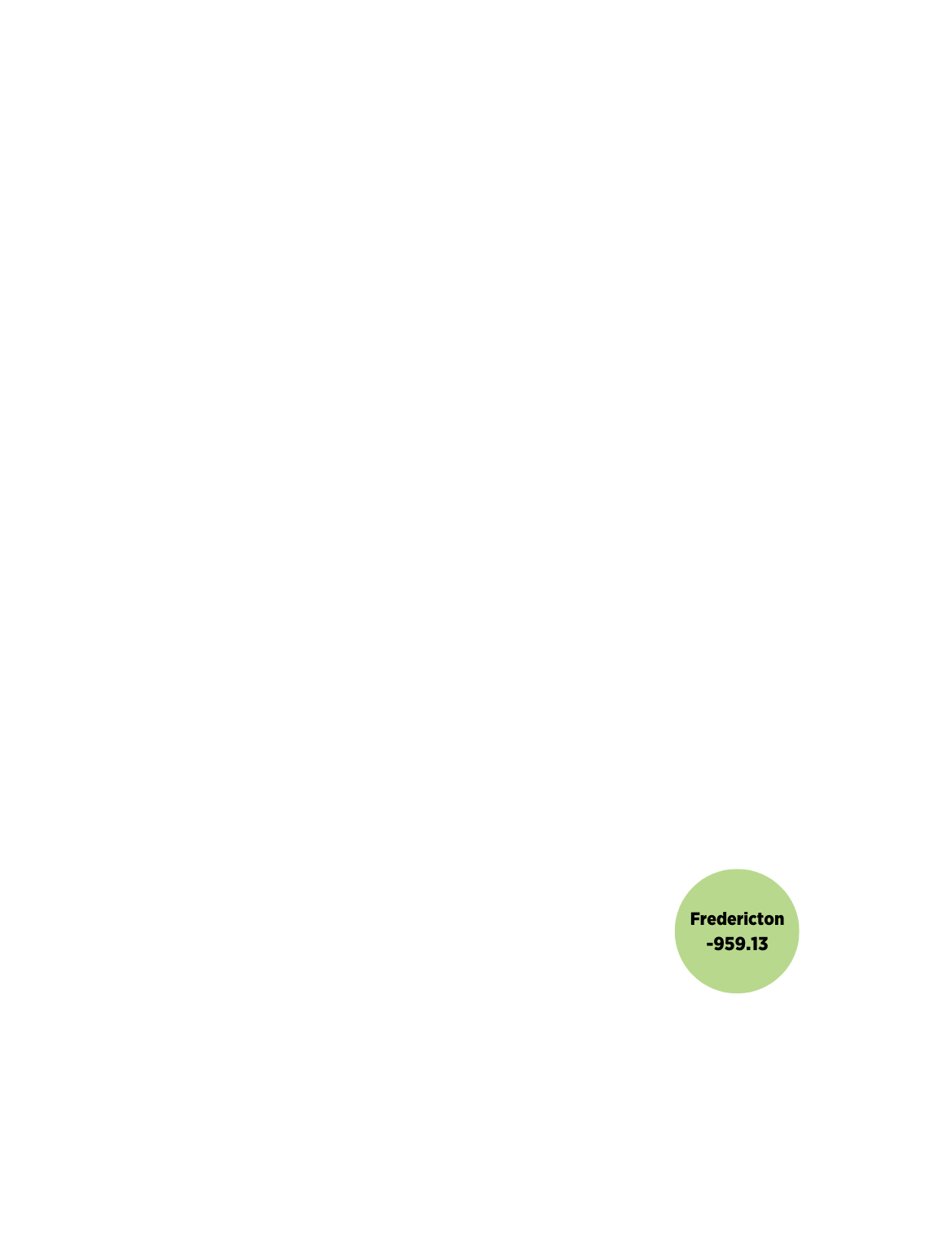

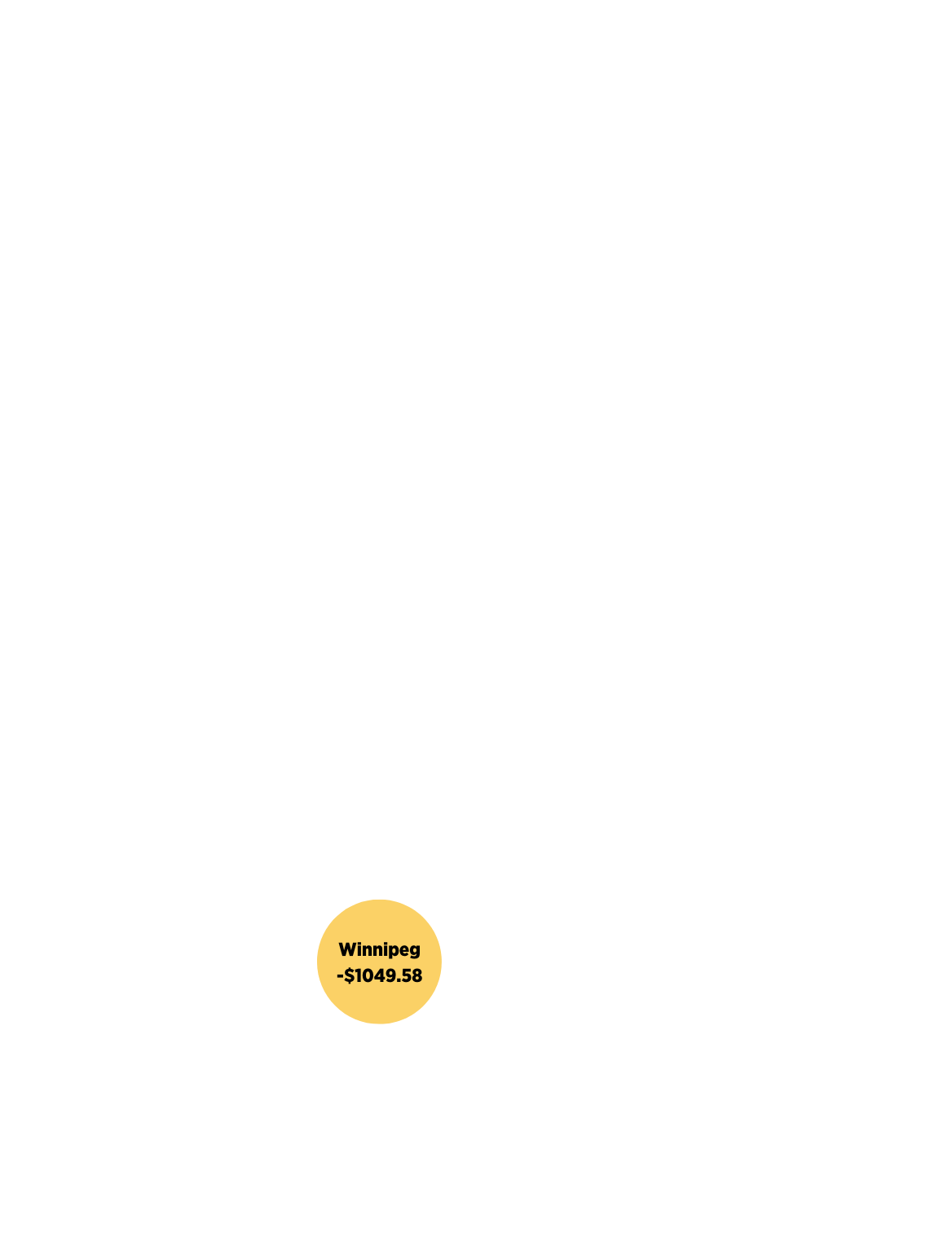

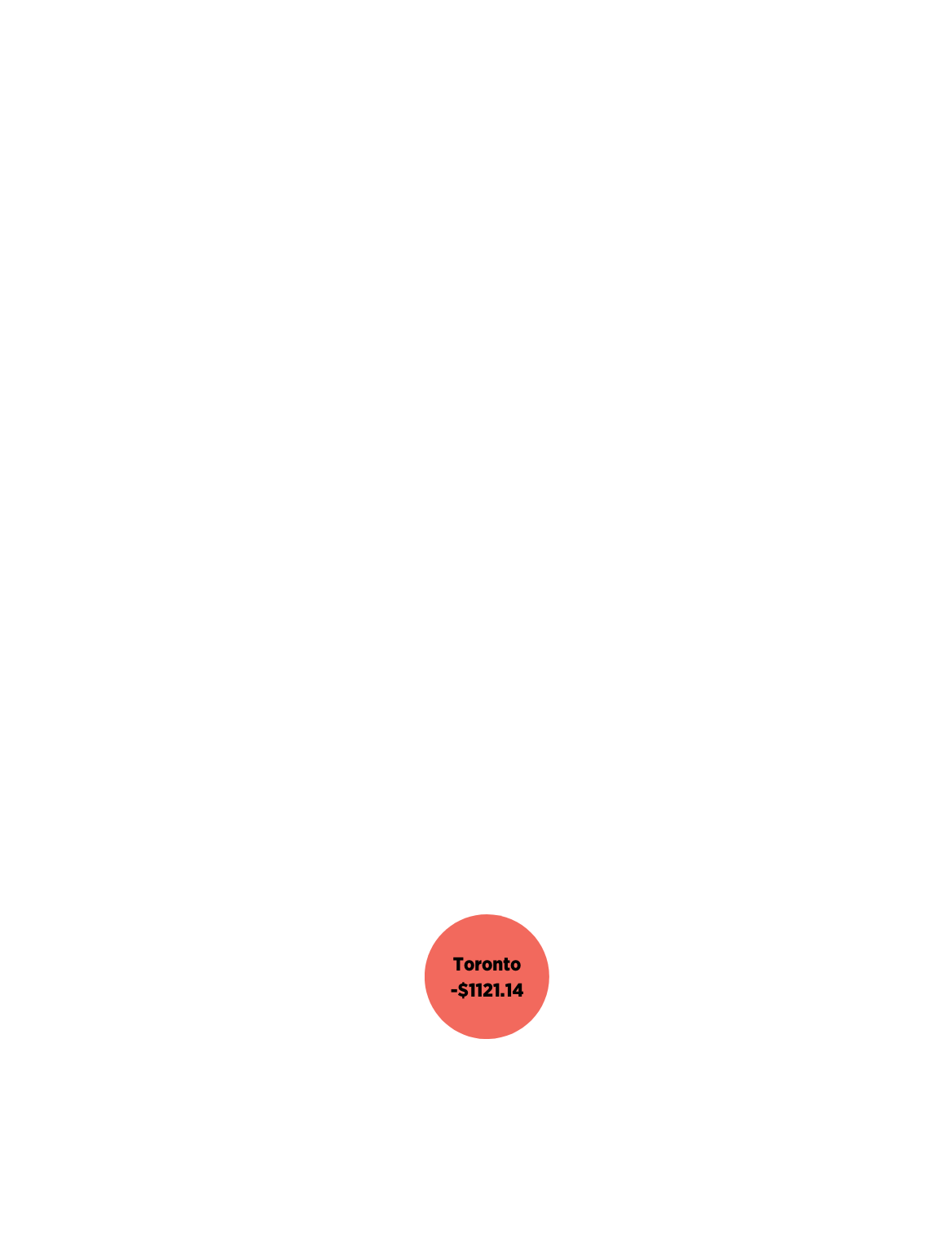

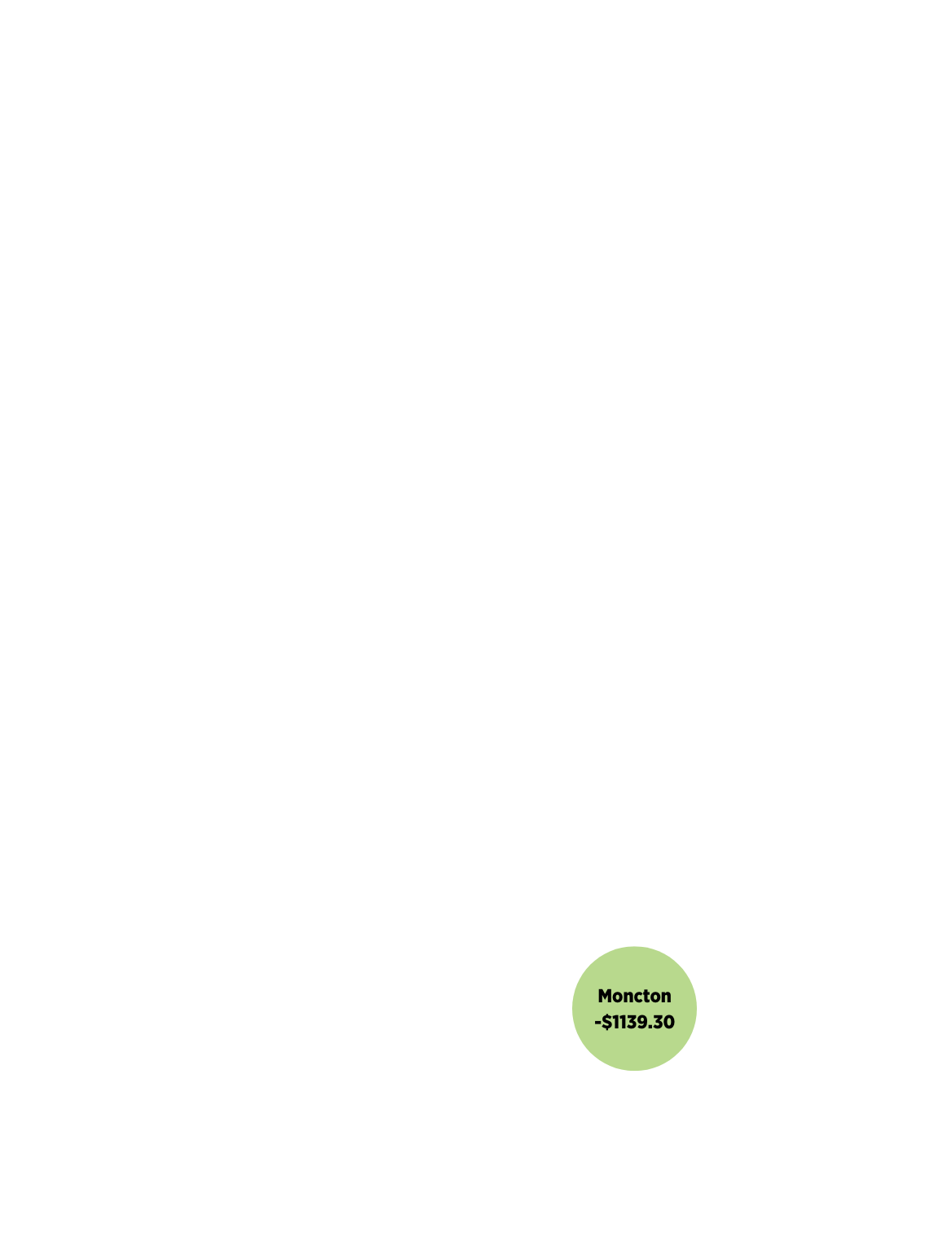

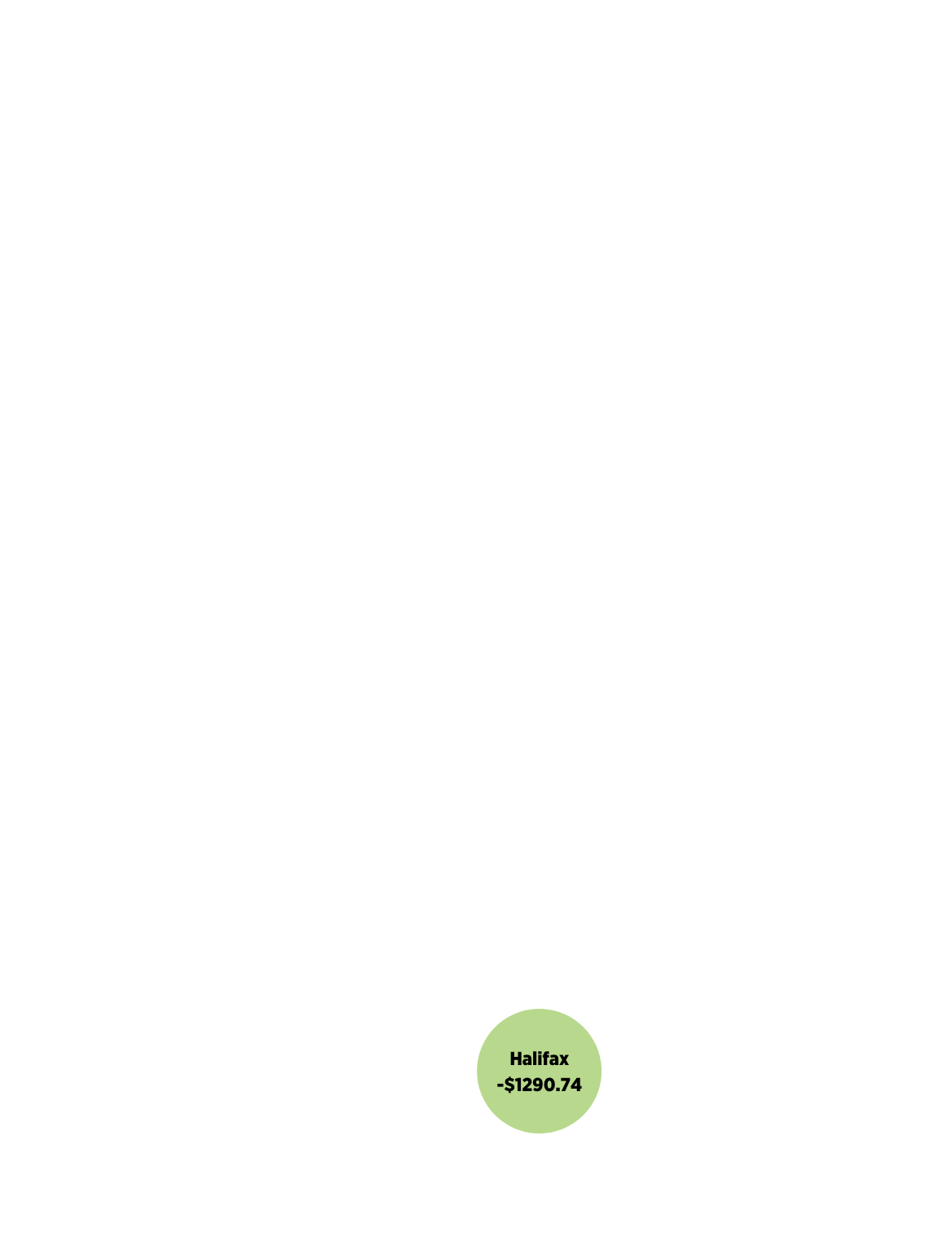

Source: Statistics Canada. Table 14-10-0023-01 Labour force characteristics by industry, annual (x 1,000).As your hours decrease, you continue to experience a monthly deficit when realistic living costs are subtracted from your income.

Realistic costs are measured by the extra costs that can bring joy to your life, like a meal at your favourite restaurant or the ability to take an uber home late at night. These extra expenses recognize the humanity of young people who are too often expected to get by on bare necessities.

The deficit that you fall into monthly represents that minimum wage is not a liveable wage.

Young Canadians across the country experience a $2 and $10 gapbetween minimum and liveable wage.[2]

Like the other young people across Canada who experience a monthly deficit, you must make changes to break even.

This means moving to the nearest urban centre to look for upskilling opportunities to move out of the minimum wage bracket.

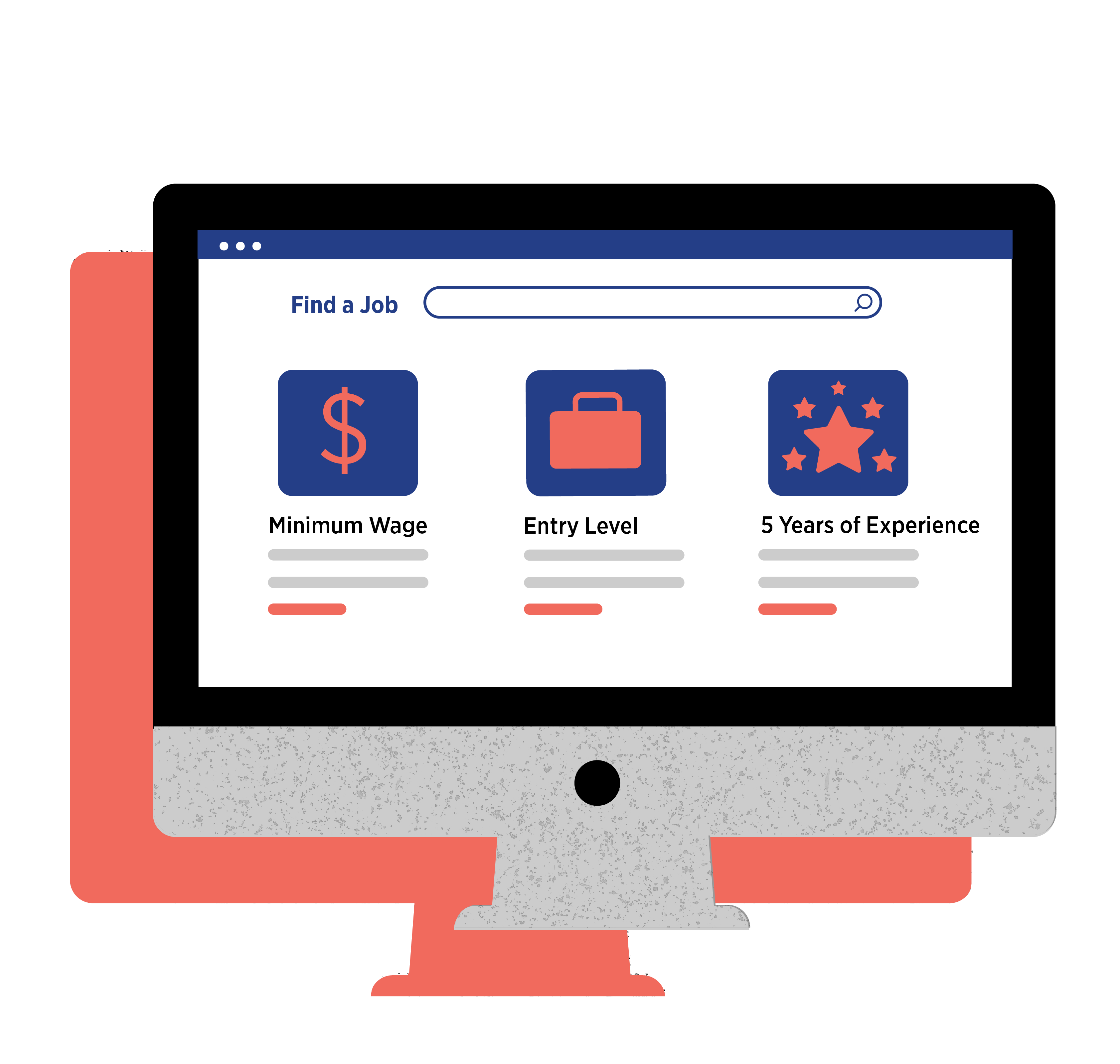

Chapter 2: Searching for work

It has now been several months since the last lockdown and you take the moment of stability to move to the urban centre near you. Toronto.

As you adjust to the city the pressure of inflation with increased living costs, mounts.

The price of goods has increased 8.1% over the past year across Canada.[4] This increased cost of living makes it difficult to continue working in the service industry.

Inflation rate in Canada between 2019 and 2022

Canadian inflation peaked at 8.1% in June 2022 due to increase in consumer goods prices, such as gasoline

Source: Statistics Canada. Table 18-10-0004-01 Consumer Price Index, monthly, not seasonally adjusted.Toronto has an estimated 35% to 36% of young people working in the service sector,[2] which is notorious for paying the lowest wages.

The minimum wage in Toronto is $15.50 an hour, but a liveable wage is $23.62 an hour.[2]

To keep up with the cost of living in your new city, you begin to consider transitioning to working in the trade sector, as you realize it might be the only feasible option for you if you want to increase your monthly income. The trade industry is male dominated across Canada.[2] This is reflected in the physical environment with many work sites without bathrooms.

This isn’t the only factor that perpetuates affordability differences between genders. People who menstruate average spending $6000 in their lifetime on menstruation products,[5] resulting in 21% of Canadians stating that they have trouble affording period products.[6] Women also average spending $35.65 more per month than men on similar products.[2]

Gender pay equity is also not a reality in Canadian cities. Young men continue to earn a higher income than young women in every Canadian city.[2]

The different wage opportunities available to our young people reveal the sexist and racial biases embedded in our culture.

Wages by Sex and Ethnicity

Women make less than men in every ethnicity group, with Latin American women making only 65% of what a man earns

Source: Statistics Canada, 2016 Census of Population.Canada has racial gaps varying from 8.1% to 19.7% in all provinces.[7]

These statistics represent the extent that youth in the role of a visible minority are disadvantaged financially at the very start of their adult life.

Chapter 3: Searching for balance

You are adjusting and budgeting for changes in the cost of living as you get settled in your urban life.

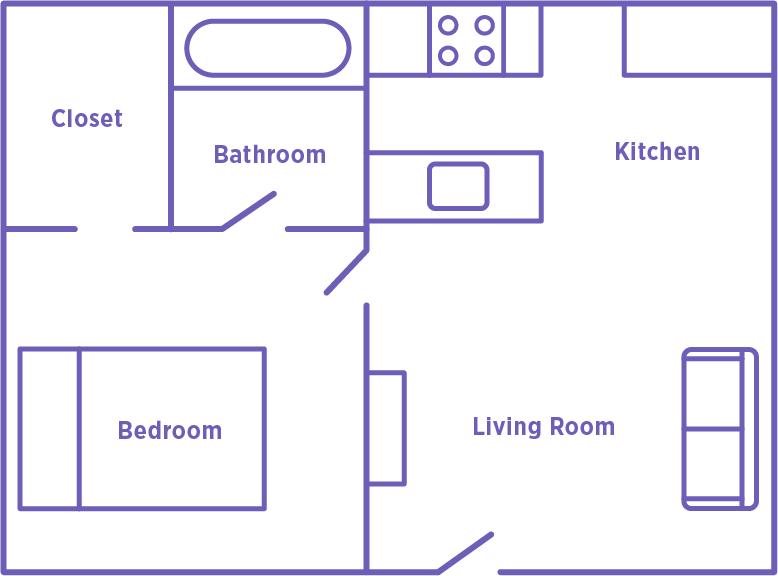

Additional costs in Toronto include...

...$1788 per month[8] to rent this one bedroom apartment...

...and $1537 annually for a transit pass.[2]

With these high costs it is harder to budget for the rising cost of food.

44% of Canadians in urban areas state that they are affected by the rise in the cost of groceries.[9]

The costs of joy that are necessary to live a balanced life, provide more financial pressure that weighs heavily.

Checking

$313.85

Rent

-$2057.99

Dining out

-$392

Groceries

-$302.36

Phone & internet

-$192.63

Entertainment

-$132.29

Health and fitness

-$61.59

Transportation

-$279

Subscriptions

-$75.12

In July of 2020 only 44.3% of young men and 30% of young women reported having very good mental health,[10] and youth continuously report lower levels of mental health than adults.

The pressure of finances, meeting societal expectations and continuously struggling to afford experiences that bring joy are all challenges that young people must overcome as they work to obtain a job that can lift them out of the minimum wage bracket.

Chapter 4: Searching for skills

The next stage of setting up your urban life is to find an education. Due to your high living costs you have to take out a loan.

The tuition costs vary by province, with Sakatchewan having the most affordable tuition and Ontario having the highest tuition at $9,743 on average.[13]

You don’t want to move to another province for school even though the average tuition in another province would be $6700,[13] significantly less that what you would have to pay annually for attending university in Ontario.

But your community and family are nearby in Ontario. It is difficult to put a price on that.

Cheaper tuition and cost of living isn’t the only variable that should be considered in a cross-country move.

Chapter 5: Searching for security

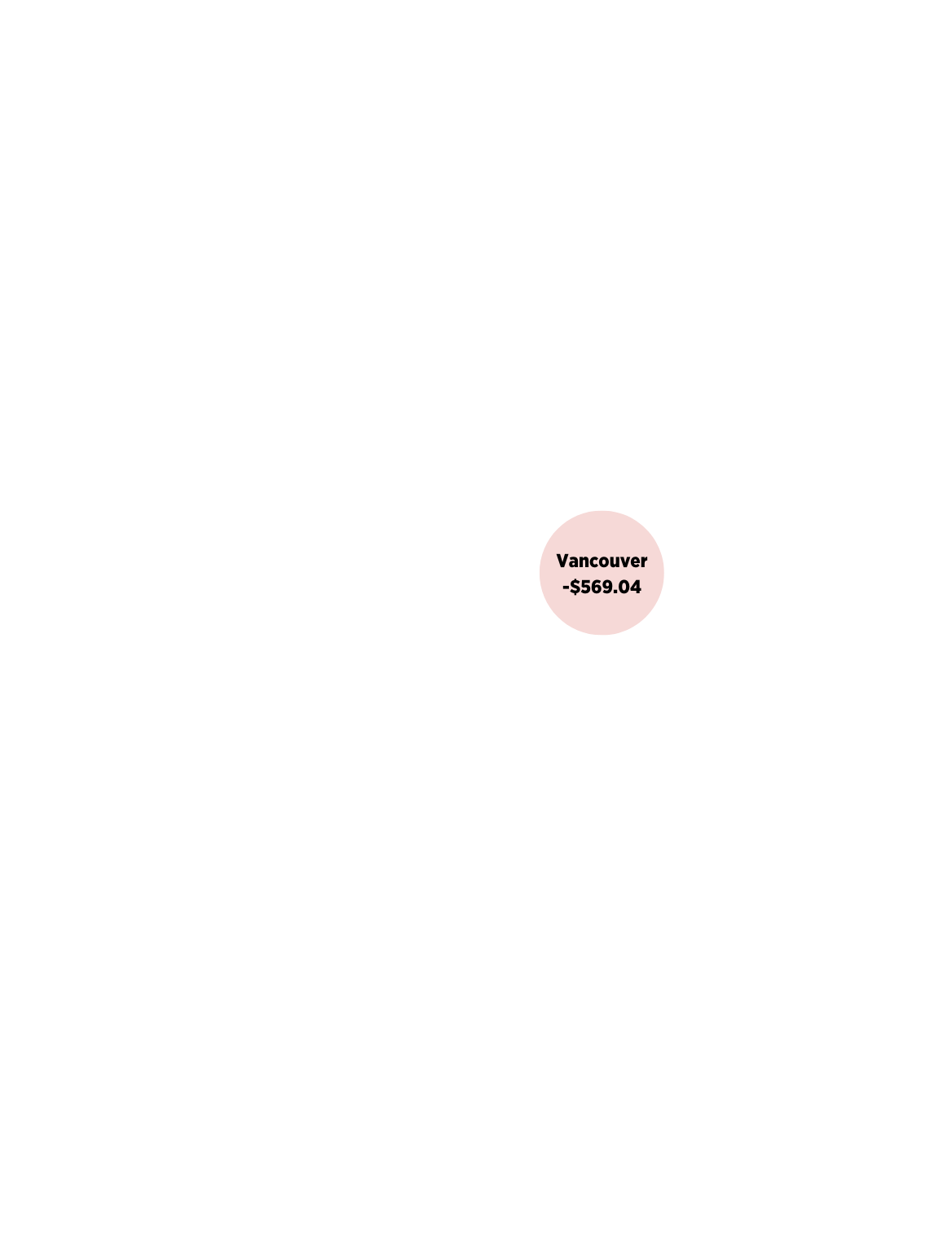

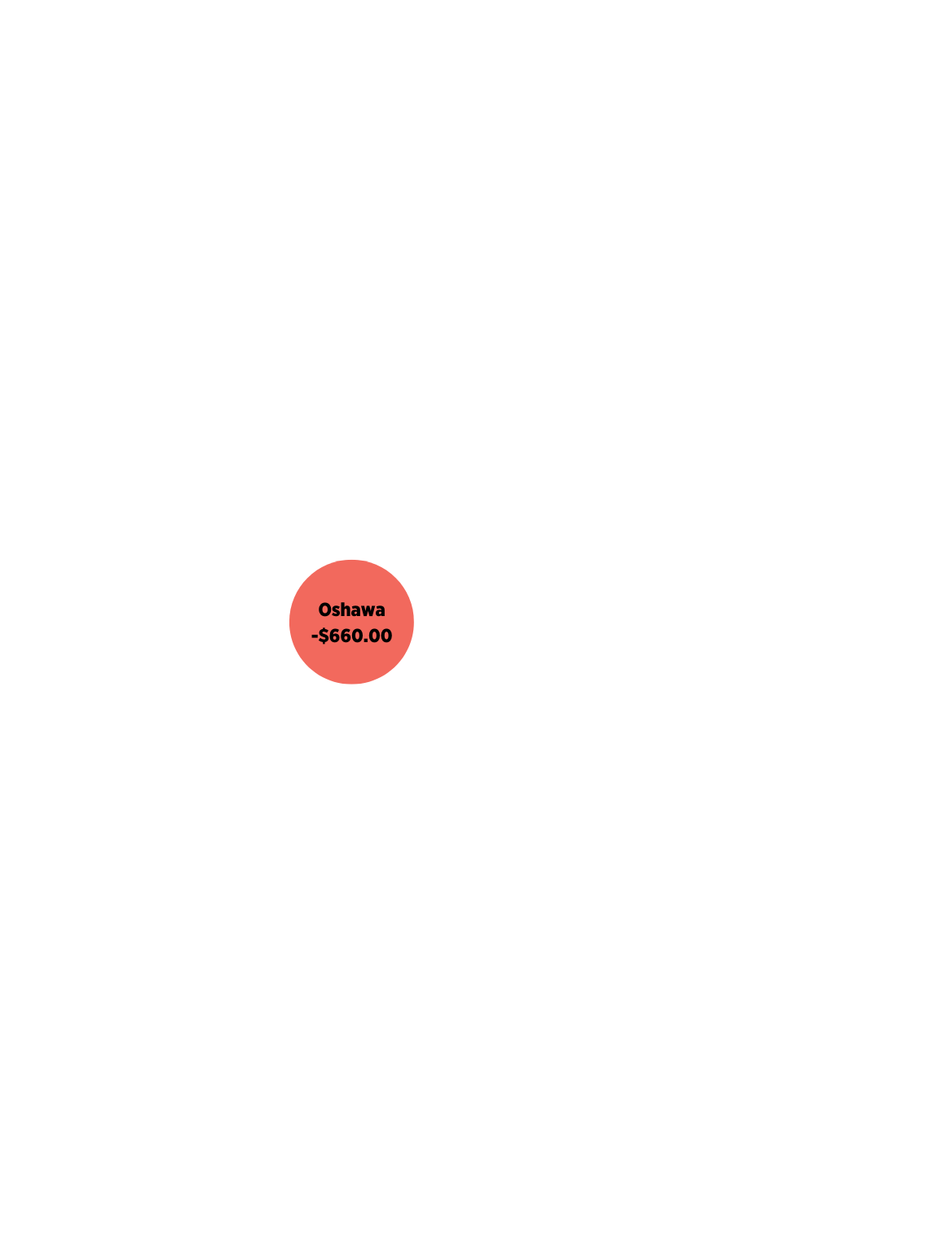

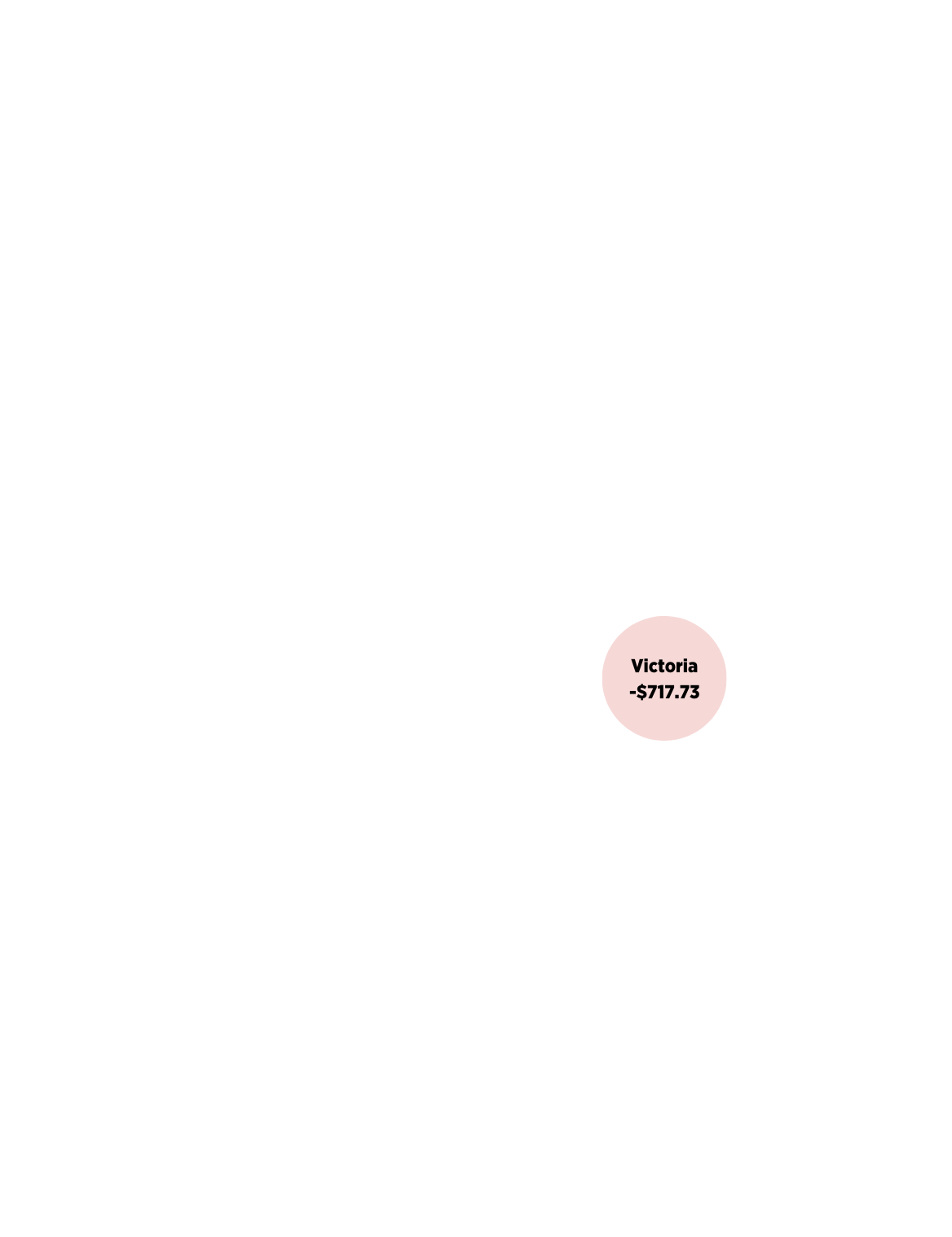

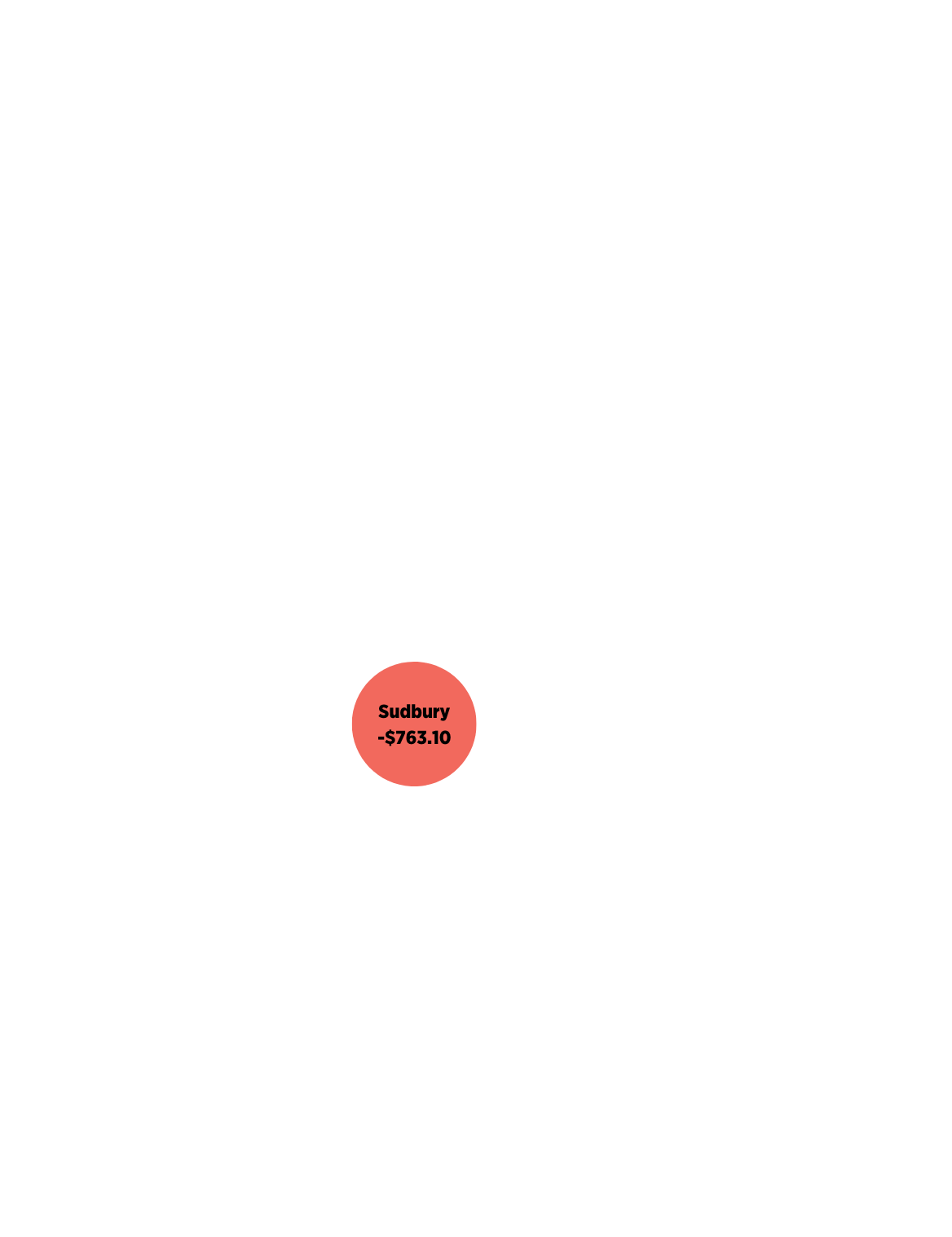

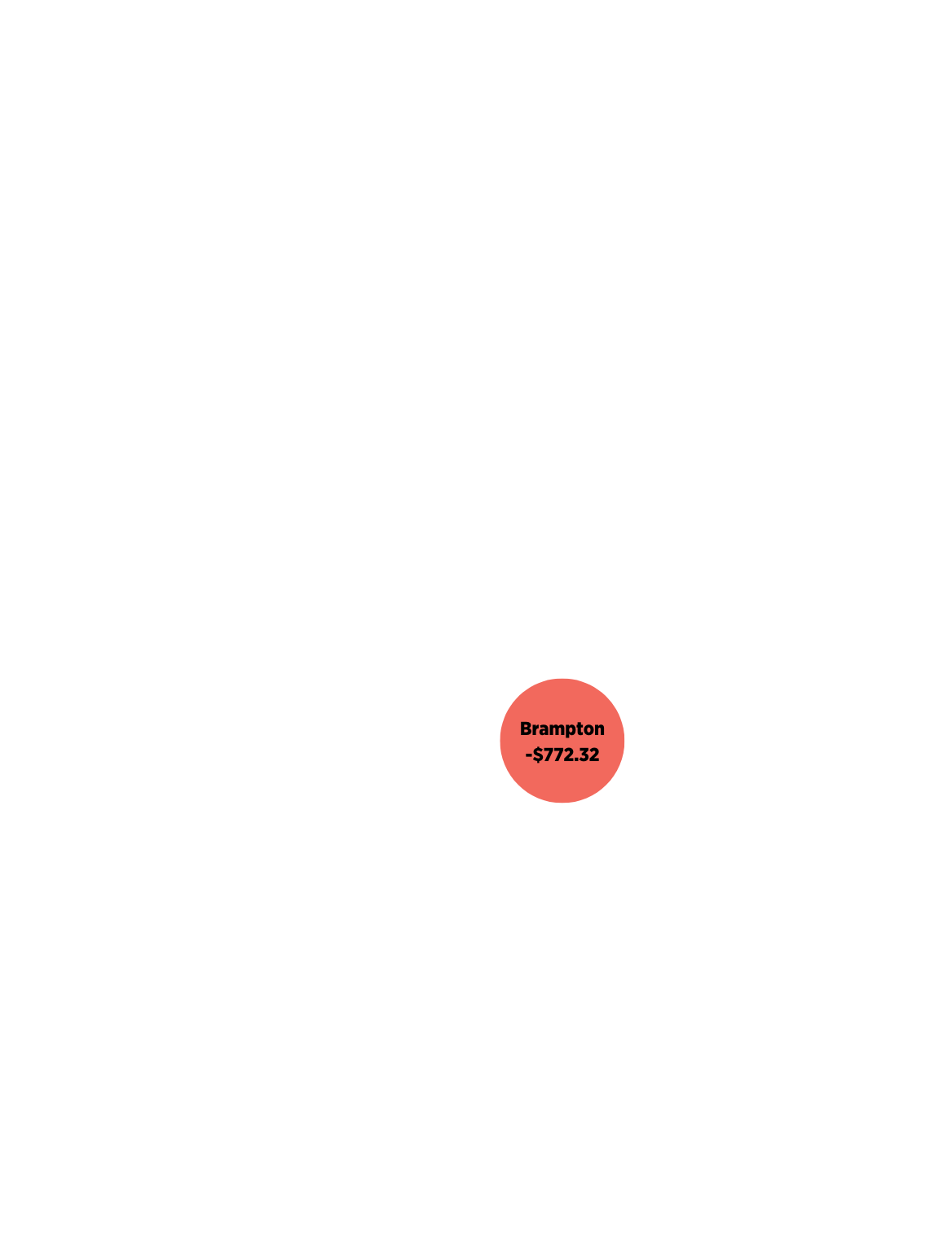

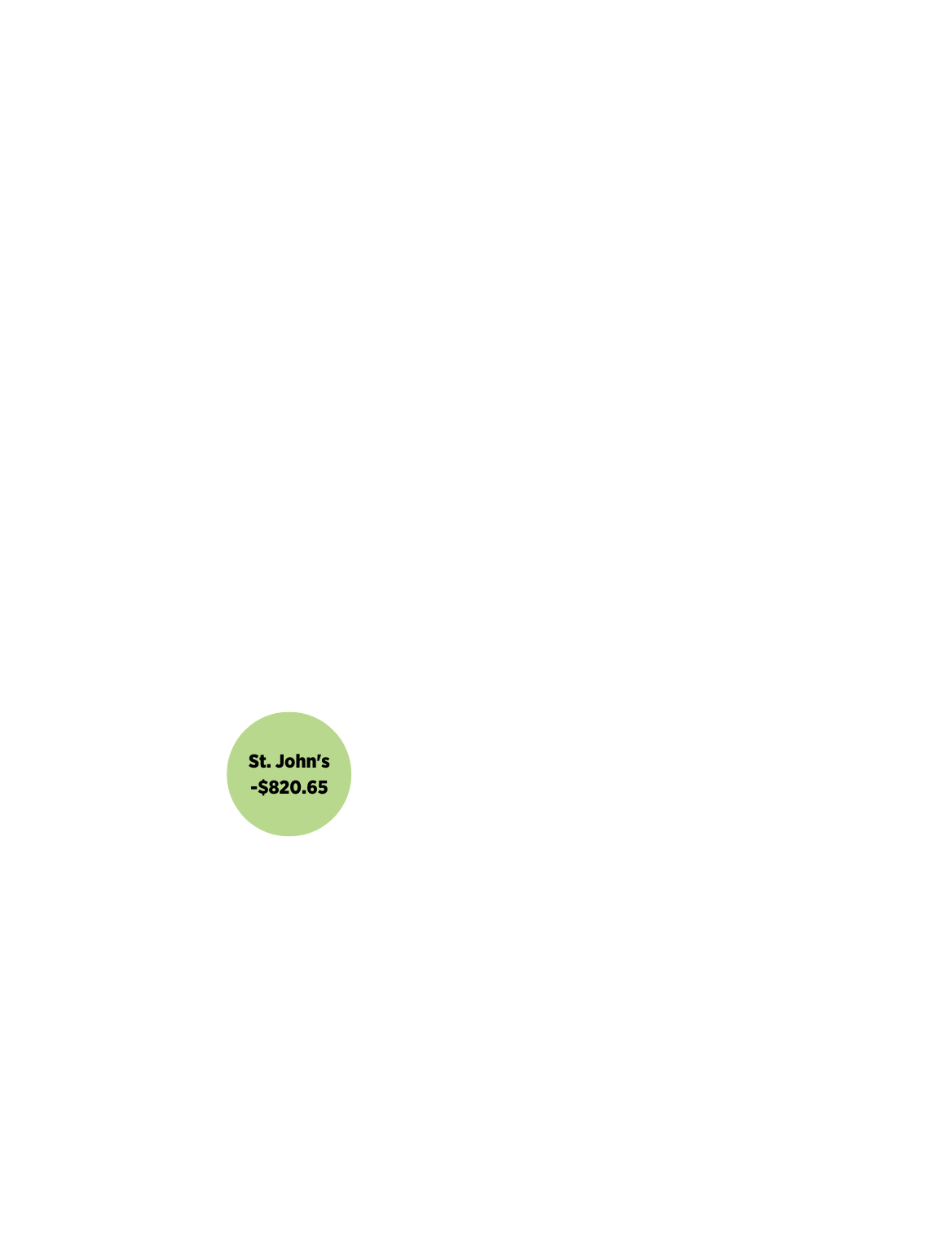

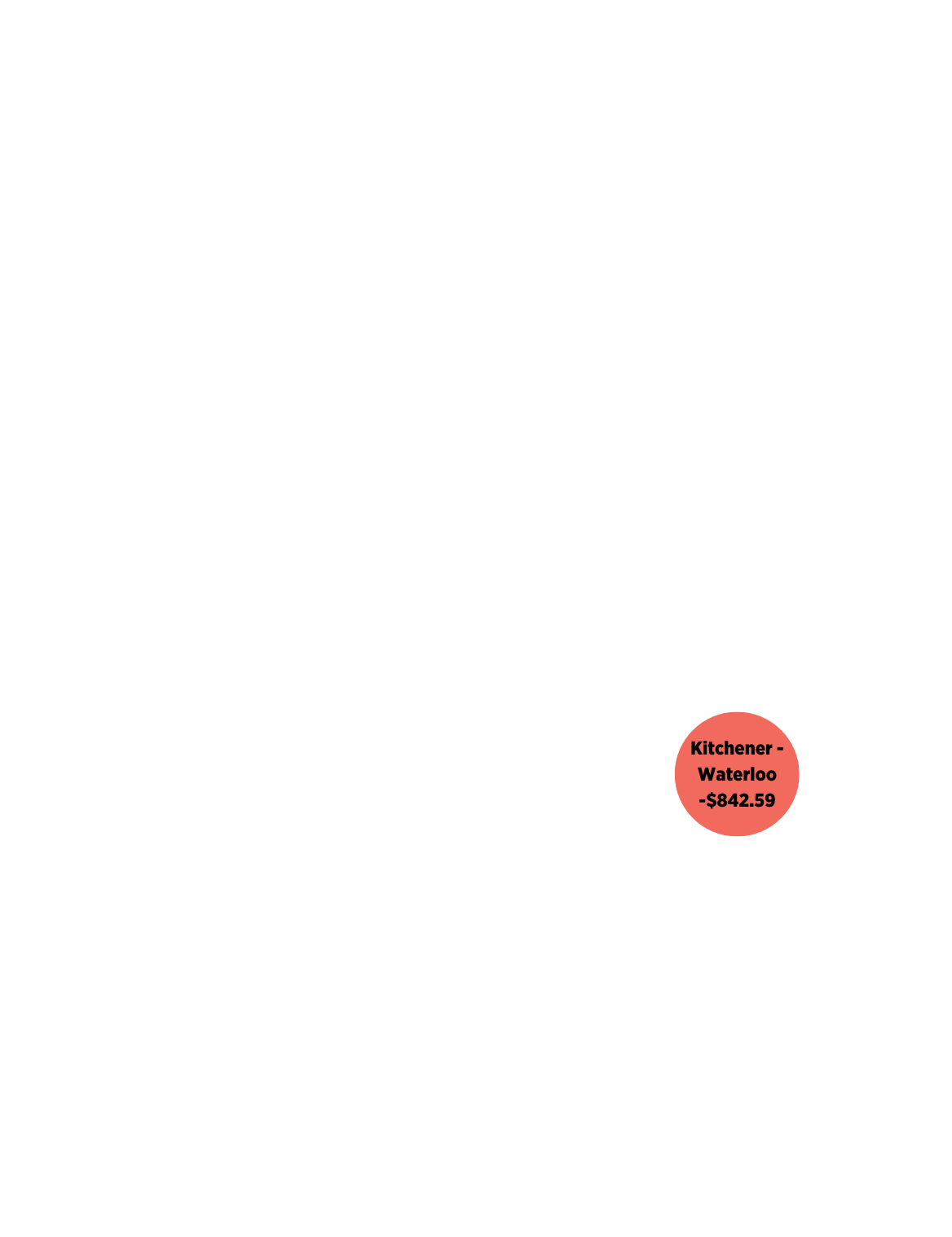

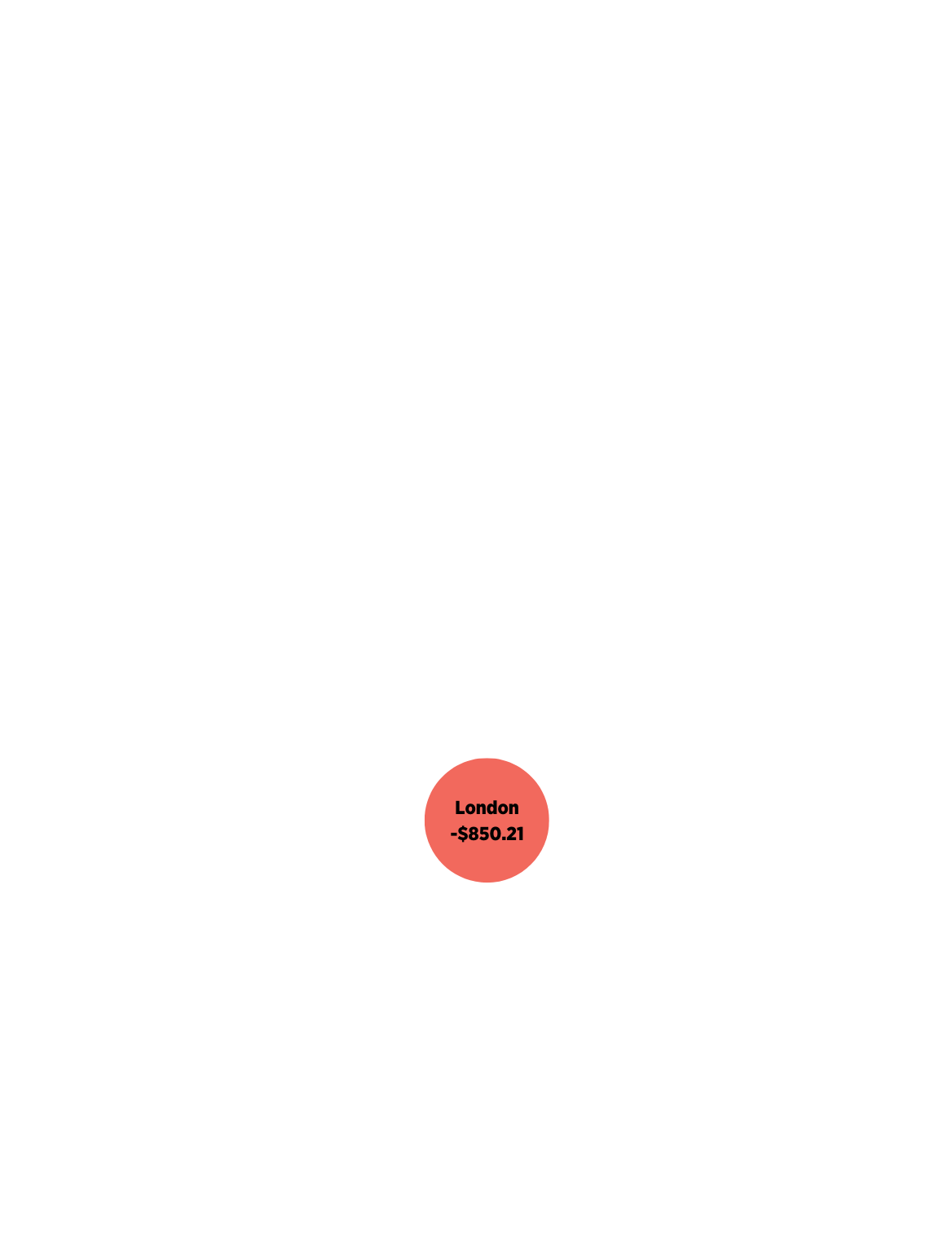

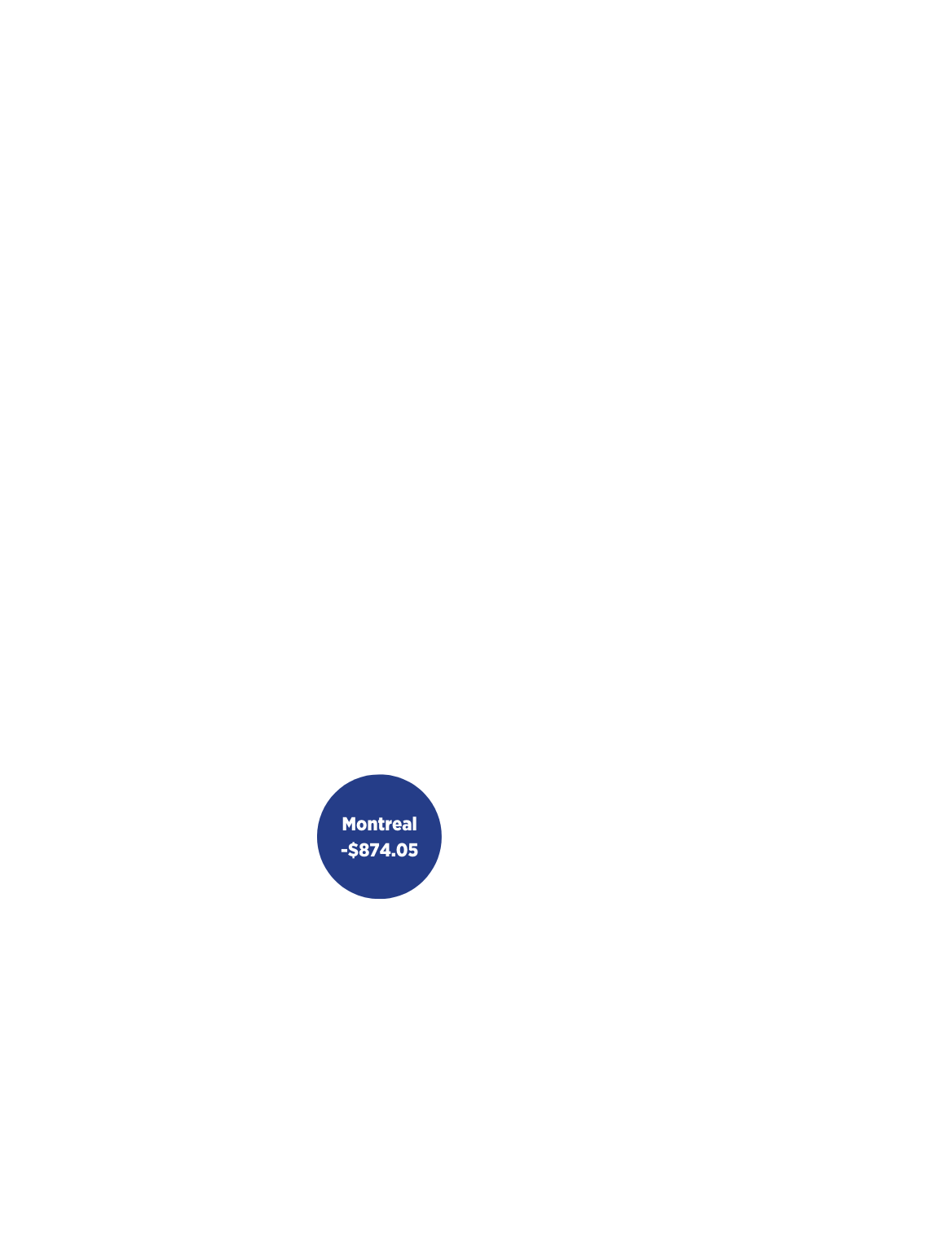

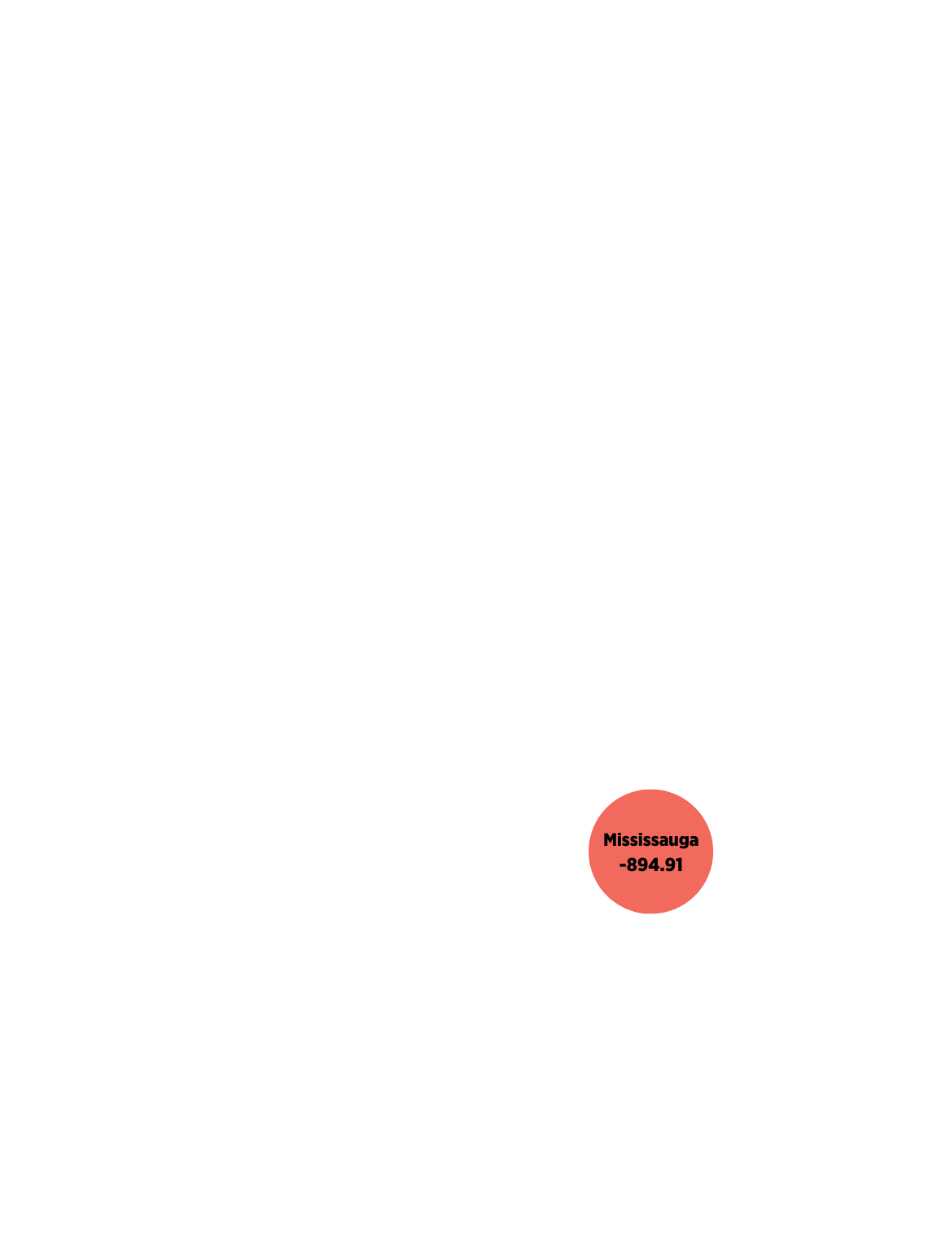

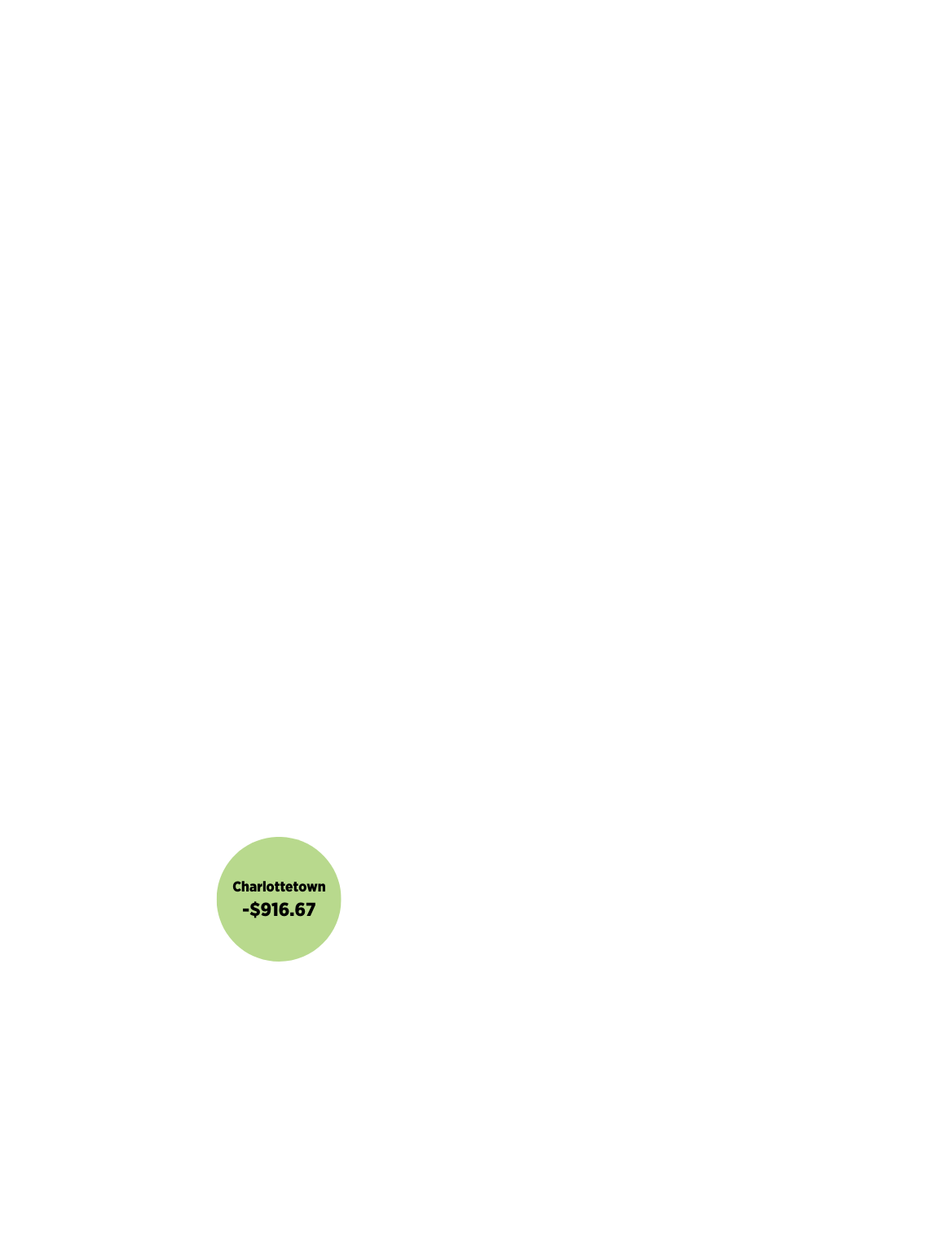

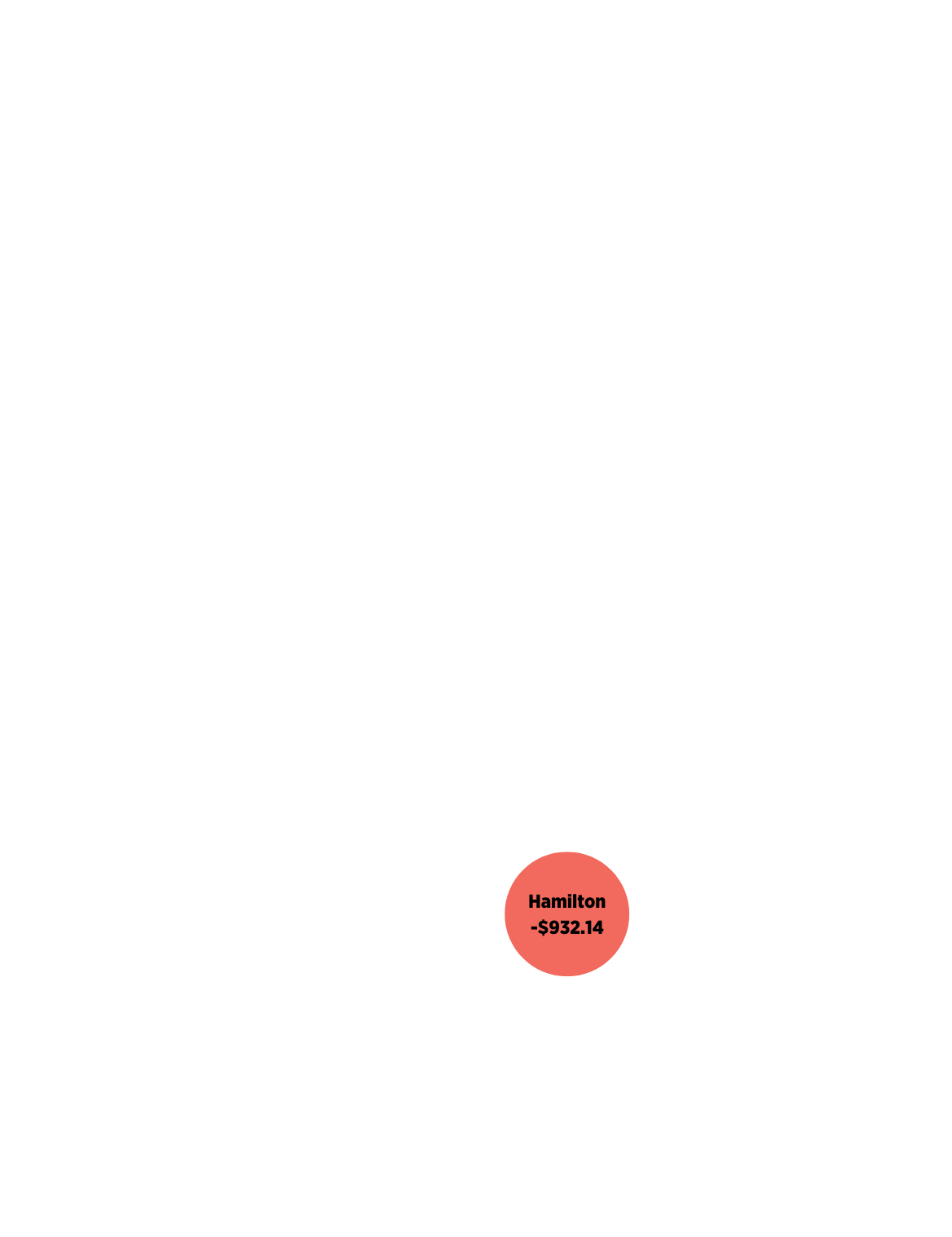

Every month you feel as if you are scraping by. You are part of a generation of young people in a deficit of $745 per month.[2] Minimum wage doesn’t keep up with the liveable, making cities feel unlivable, yet you don’t have another option. You must live in an urban area in order to upskill and move away from the minimum wage bracket so that you can have future successes.

Whatever you do doesn’t feel like enough.

It feels like you are constantly searching for a sense of financial security that is just out of reach.